The Texas Life and Health Insurance Exam is a critical step for aspiring agents, ensuring they understand policies, legal requirements, and ethical practices in the industry.

Overview of the Exam

The Texas Life and Health Insurance Exam assesses knowledge of insurance principles, policies, and state-specific regulations. It covers life insurance, annuities, health insurance, and Texas laws. The exam includes multiple-choice questions, with a focus on understanding concepts and applying them to real-world scenarios. Passing the exam is a requirement for obtaining a license to sell life and health insurance in Texas. It is designed to ensure candidates are competent in providing ethical and informed services to clients.

Importance of Preparation

Thorough preparation is essential for success on the Texas Life and Health Insurance Exam. The exam covers complex topics, and without proper study, candidates may struggle to understand key concepts. Effective preparation helps build confidence, reduces exam anxiety, and ensures a strong grasp of both state and federal insurance regulations. Utilizing study guides, practice exams, and flashcards can significantly improve retention and readiness. Adequate preparation not only increases the likelihood of passing but also equips future agents with the knowledge needed to serve clients effectively.

Understanding the Exam Format

The Texas Life and Health Insurance Exam is divided into two sections: Life Insurance (90 questions) and Health Insurance (90 questions), with a 2.5-hour time limit.

Breakdown of Question Types

The Texas Life and Health Insurance Exam features multiple-choice questions designed to test knowledge and application of insurance concepts. Questions are divided into two main categories: knowledge-based and application-based. Approximately 60% of the questions focus on general insurance concepts, while 30% apply these concepts to real-world scenarios. The remaining 10% emphasize Texas-specific insurance laws and regulations. The exam also includes scenario-based questions that require analyzing policies and benefits. Test-takers must demonstrate the ability to interpret complex policy details and apply them correctly. Effective time management and strategic guessing are essential for success.

Time Limits and Scoring

The Texas Life and Health Insurance Exam consists of 150 multiple-choice questions with a 2-hour and 30-minute time limit. Candidates must score at least 70% to pass. The exam is divided into two parts: life insurance (90 questions) and health insurance (60 questions). Scoring is based on correct answers, with no penalty for guessing. Results are provided immediately after completing the exam. A passing score allows candidates to apply for their insurance license, while a failing score requires a 30-day wait period before reattempting the exam. Time management is crucial for success.

Key Topics Covered in the Exam

The exam covers life insurance policies, health insurance plans, and Texas-specific regulations. Topics include policy types, riders, benefits, and legal requirements. Understanding these areas is essential for success.

Life Insurance Policies and Riders

Life insurance policies provide financial protection to beneficiaries upon the insured’s death. Common types include term life, whole life, and universal life. Riders, such as the waiver of premium or accelerated death benefit, offer additional benefits. Understanding these policies and riders is crucial for the exam, as they form a significant part of the content outline provided by the Texas Department of Insurance.

Health Insurance Plans and Benefits

Health insurance plans offer coverage for medical expenses, ensuring access to essential care. Common types include HMOs, PPOs, and EPOs, each varying in provider networks and cost-sharing. Benefits often include preventive care, hospital stays, and prescription drugs. Understanding plan types, deductibles, and maximum out-of-pocket costs is vital. Texas-specific regulations may also impact coverage options. Studying these details helps candidates grasp how policies meet diverse healthcare needs, a key focus of the exam.

Texas-Specific Insurance Regulations

Texas imposes unique insurance regulations that agents must understand. These include specific policy terms, beneficiary designations, and pre-existing condition rules. The Texas Department of Insurance oversees compliance, ensuring fair practices. Key areas cover grace periods for premium payments and mandatory coverage for certain health conditions. Familiarity with these state-specific rules is crucial for agents to operate legally and ethically, protecting both clients and themselves in transactions. These regulations often differ from federal standards, making them a priority in exam preparation.

Study Materials and Resources

Utilize the official Texas Department of Insurance content outline, recommended study guides, and online practice exams to prepare thoroughly for the exam. These resources are essential for success.

Official Content Outline from the Texas Department of Insurance

The official content outline provided by the Texas Department of Insurance is a comprehensive guide detailing the exam’s structure and topics. It includes life insurance policies, health insurance plans, and state-specific regulations. This outline ensures candidates understand the scope of the exam and focus their studies effectively. By reviewing this document, test-takers can identify key areas to prioritize, ensuring they cover all necessary material for the Texas Life and Health Insurance Exam.

Recommended Study Guides and Textbooks

Several study guides and textbooks are highly recommended for preparing for the Texas Life and Health Insurance Exam. The Texas Life and Health Insurance License Exam Prep by Americas Professor is a top choice, offering detailed explanations and practice questions. Kaplan Financial Education also provides comprehensive study materials, including textbooks and online resources. Additionally, the Official Content Outline from the Texas Department of Insurance is a must-have for understanding exam topics. These resources ensure thorough preparation and help candidates master key concepts effectively.

Online Practice Exams and Simulators

Online practice exams and simulators are invaluable tools for preparing for the Texas Life and Health Insurance Exam. Platforms like Kaplan Financial Education and Americas Professor offer realistic exam simulations, mimicking the actual test format and timing. These resources include hundreds of practice questions, detailed explanations, and performance tracking. Additionally, Quizlet provides interactive flashcards and practice tests that cover key terms and concepts. Regular use of these tools helps build confidence and ensures readiness for the actual exam experience.

Effective Study Strategies

Develop a structured study schedule, focusing on active learning techniques like summarization and self-quizzing. Regularly review complex topics and use diverse resources to reinforce understanding and retention.

Creating a Study Schedule

Developing a structured study schedule is essential for effective preparation. Start by breaking down the exam content into manageable topics and allocate specific time slots for each. Set realistic daily goals and ensure consistent review of complex subjects. Incorporate active learning methods, such as summarizing key concepts and self-quizzing, to enhance retention. Schedule regular breaks to maintain focus and avoid burnout; Use practice exams to assess your readiness and adjust your study plan accordingly. Consistency is key to mastering the material efficiently.

Using Flashcards for Key Terms

Flashcards are an effective tool for memorizing key terms and concepts. Create cards with terms on one side and definitions or explanations on the other. Review them regularly to reinforce memory. Use online platforms like Quizlet for interactive learning and tracking progress. Prioritize complex terms and state-specific regulations to ensure comprehension. Flashcards offer a portable and flexible way to study, making them ideal for quick reviews during commutes or breaks. Consistent use enhances retention and exam readiness.

Importance of Practice Exams

Practice exams are crucial for assessing your readiness and identifying weak areas. They simulate real test conditions, helping you manage time effectively and reduce exam-day anxiety. By taking practice exams, you can familiarize yourself with the question format and content, ensuring a smoother experience during the actual test. Regular practice also builds confidence and reinforces key concepts. Consistent use of practice exams is essential for achieving a high score and ensuring thorough preparation for the Texas Life and Health Insurance Exam.

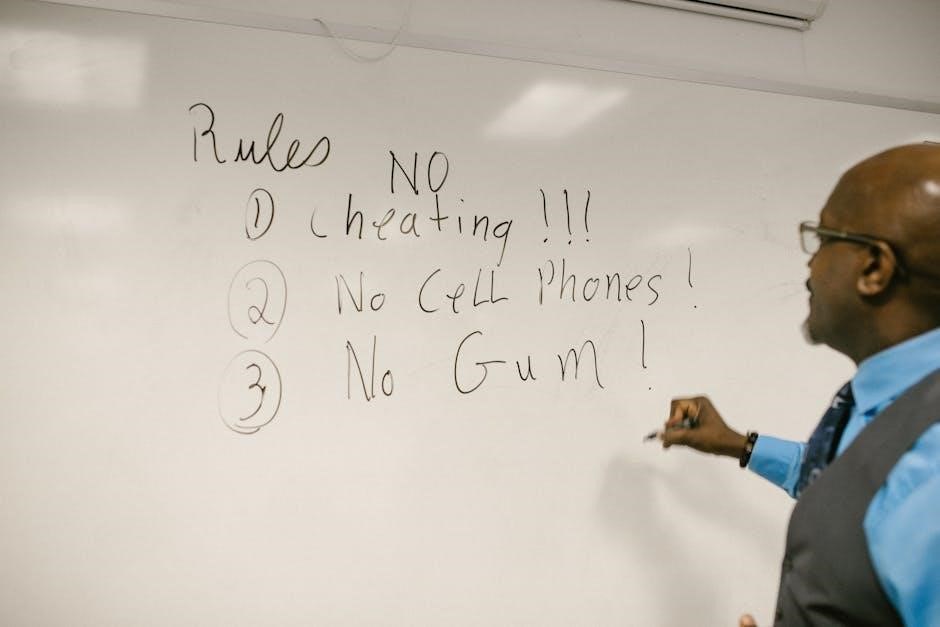

Common Mistakes to Avoid

- Overlooking Texas-specific insurance laws and regulations.

- Poor time management during the exam.

- Ignoring complex policy details and terminology.

Overlooking State-Specific Laws

Many candidates fail to account for Texas-specific insurance regulations, such as state-mandated benefits and unique policy requirements. Ignoring these details can lead to incorrect answers, as Texas laws often differ from general insurance principles. Failing to study the Texas Department of Insurance’s content outline thoroughly increases the risk of errors. It is crucial to focus on state-specific clauses, licensing requirements, and consumer protections to avoid this common mistake and ensure success on the exam.

Not Managing Time Effectively During the Exam

Poor time management is a frequent issue, leading to incomplete answers and rushed decisions. Candidates often spend too long on complex questions, leaving insufficient time for others. To avoid this, practice with timed practice exams to build speed and accuracy. Allocate a set amount of time per question and move forward if stuck. This strategy ensures all questions are addressed, maximizing the chances of achieving a passing score. Effective time management is essential for exam success.

Ignoring Complex Policy Details

Overlooking complex policy details is a common mistake that can lead to incorrect answers. Life and health insurance exams often test nuanced concepts, such as riders, exclusions, and state-specific regulations. Candidates who skip or misunderstand these details risk failing. To avoid this, thoroughly study policy provisions and practice with sample questions. Flashcards and practice exams are excellent tools to master complex terms and scenarios. Ignoring these details can result in missed points and a lower overall score, emphasizing the need for comprehensive preparation.

Eligibility and Registration

To register for the Texas Life and Health Insurance Exam, candidates must meet eligibility requirements, complete pre-licensing education, and schedule the exam through Pearson VUE.

Requirements for Taking the Exam

To take the Texas Life and Health Insurance Exam, candidates must complete a 24-hour pre-licensing education course and register through Pearson VUE. Applicants must be at least 18 years old, provide proof of Texas residency, and pass a background check; They must also submit required documents, such as identification and proof of course completion. Candidates with disabilities may request accommodations, which must be approved in advance. Meeting these requirements ensures eligibility to sit for the exam and proceed toward licensure.

Steps to Register for the Exam

To register for the Texas Life and Health Insurance Exam, candidates must create an account on the Pearson VUE website. After logging in, they should select the appropriate exam and submit required documents, such as proof of completing pre-licensing education. Once documents are approved, candidates can schedule their exam date, time, and location. Payment of the exam fee is required at this stage. Finally, candidates will receive a confirmation email with details to print and bring to the test center.

Accommodations for Candidates with Disabilities

Candidates with disabilities may request accommodations for the Texas Life and Health Insurance Exam. These include extended time, a reader, or a separate testing room. Requests must be submitted through Pearson VUE’s accommodations request form, accompanied by documentation from a licensed professional. Once approved, accommodations are applied to the exam session. Visit the Pearson VUE website for detailed instructions and forms to ensure equal access to the exam. This ensures all candidates can complete the exam fairly and effectively.

Post-Exam Procedures

After completing the exam, candidates receive immediate results. A passing score is required to proceed with licensing. Successful candidates can apply for their license through the Texas Department of Insurance. If failed, candidates must wait 30 days before retaking the exam. Results are valid for one year. Ensure all steps are followed to complete the licensing process efficiently.

Receiving and Interpreting Results

Exam results are provided immediately upon completion. Candidates receive a pass/fail notification and their overall score. A minimum score of 70% is required to pass. Detailed breakdowns of performance in each section are provided for candidates who fail, helping identify areas for improvement. Successful candidates can proceed with their license application within one year of passing. Results are valid for one year. For candidates who fail, a 30-day waiting period is required before retaking the exam. Understanding these results is crucial for next steps.

Next Steps After Passing the Exam

After passing the Texas Life and Health Insurance Exam, candidates can apply for their license through the Texas Department of Insurance (TDI). This involves submitting an application, paying required fees, and completing a background check. Applicants must also disclose any legal or regulatory issues. Once approved, the license is issued, allowing individuals to sell life and health insurance products in Texas. Additionally, licensees must complete continuing education requirements to maintain their certification and stay updated on industry regulations and best practices.

Leave a Reply

You must be logged in to post a comment.